The foundation on which Memphis 3.0, the first comprehensive plan for the city in more than 40 years, is built is data. Earlier this month, we posted some of the factoids in the report that we found interesting. Here is part 2:

* Nearly half of households spend more than 30% of their income on housing (the standard measure for housing affordability) indicating a need for not only more affordable housing but a balanced market approach with a focus on housing affordability, type and quality

* Of the new households projected to choose Memphis as their home, research shows an overwhelming preference for multifamily units (47%), followed by a split demand for renovated single family housing stock and new single family construction (24% and 23% respectively). A Market Analysis completed for the plan indicates a surge in interest for single-family attached housing, creating room in the market for missing middle housing and increasing density and affordability in strategic areas of the city. Missing middle housing is “a range of multi-unit or clustered housing types compatible in scale with single-family homes that help meet the growing demand for walkable urban living.”

* The overall share of Memphis households who own their home was 49% in 2015 while homeownership rates for the US were nearly 64% during that same time period. The decline in homeownership was not uniform across the city; it was experienced primarily by African-American households, and more in certain districts than others such as Frayser, South, Jackson, and Oakhaven-Parkway Village. These factors increase the difficulty for the majority of Memphis’ population (African-Americans and other people of color) to build and transfer wealth and more importantly move out of poverty.

* For many decades, Shelby County has held a dominant position in the transportation and warehousing sector as compared to the U.S. and peer regions. However, in recent years, Indianapolis and Louisville have outpaced Shelby County’s jobs growth in this sector. Memphis also has specializations in administrative and support services (e.g., business support, back office, and building services), specialized medicine, medical technology manufacturing, resource-intensive manufacturing and materials processing (e.g., paper manufacturing, grain and oilseed milling, wood products manufacturing, and food and beverage manufacturing), and tourism and entertainment.

* The city’s total retail inventory grew by an estimated 17%. In comparison, the population grew by 1% between 2000 and 2015. Some amount of new development will be necessary to replace older strip malls and shopping centers, which may not meet the preferences of modern retailers (especially national chains). Overall, however, the city of Memphis has an estimated 82 square feet of retail per person – compared to a national average of 23.5 square feet of retail per person, which is considered an oversupply.

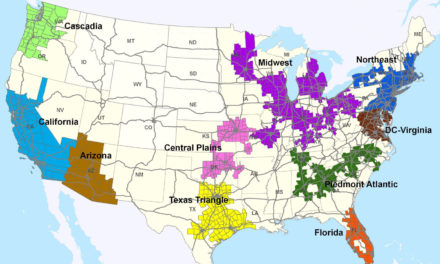

* Over 50% of jobs in Memphis are concentrated in three general areas, the Core City (Downtown and Midtown), East Memphis, and the area east of the airport. On average, it takes a Memphian 22 minutes to travel to work by car and 60 minutes or more for those who take public transportation. This alone reduces the desirability of using public transit as a primary mode to work.

* The Center for Neighborhood Technology reports that the average cost of car ownership in Memphis is $11,465 a year including insurance, maintenance, and gas. For individuals and households who earn less than the median household income ($36,445), that’s nearly one-third of their gross income. By aligning land use planning and transportation planning, a more frequent and connected transit system could begin to decrease the financial burden on residents by better supporting those who have no vehicle available and reducing the need for automobile ownership.

**

Join us at the Smart City Memphis Facebook page for daily articles, reports, and commentaries relevant to Memphis.