By Jimmie Covington

Shelby County’s assessed value of property for tax purposes this year – which includes reappraisal figures – is up almost $2.1 billion from last year, certified tax roll figures released April 20 by the County Assessor’s Office show.

Countywide, the increase is 12.4 percent, including 11.9 percent in Memphis. The highest percentage increases among suburban municipalities are 14.9 percent in Arlington and 14.6 percent in both Collierville and Millington.

The largest dollar value increase among the suburban municipalities is $219.4 million in Collierville.

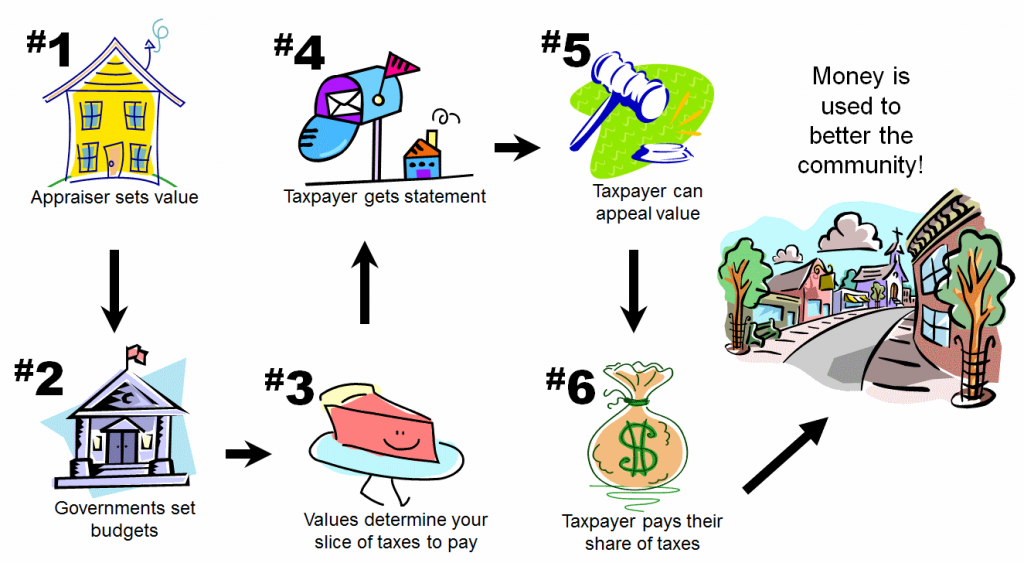

Tennessee’s truth-in-taxation law requires all local governments to calculate and adopt a resolution identifying a certified tax rate that would bring in the same amount of property tax revenue as the previous year. (The calculations must be approved by state Board of Equalization officials.)

Options

Governments can set a rate higher than the certified rate by publicly advertising that they plan to adopt a higher rate, holding a public hearing and then adopting the higher rate.

Tax rates higher than the certified rates have been proposed in at least two suburbs – Germantown and Bartlett.

Some Shelby County commissioners have said they want to cut county tax revenue by setting a rate lower than the certified rate.

The governments are allowed to receive new revenue from new construction and other properties that have come onto the tax roll for the first time in the past year.

Calculations used by county officials show new property-assessed value growth totaled $489 million in the year that ended last Dec. 31. Of the growth, $224.5 million was in real estate and $264.5 million was in taxable personal property.

Appeals

Thousands of property owners are expected to appeal their reappraisal figures to the Shelby County Board of Equalization before a June 30 deadline. When the Assessor’s Office mailed out the reappraisal values several weeks ago, the notices suggested that people who believed their new value was incorrect should request an informal review by the assessor’s staff.

The office has announced that taxpayers who were not satisfied with the review results or have not received the results by June 9, should file an appeal with the county Board of Equalization. The board office may be contacted at 901-222-7300 or online at boe.shelbycountytn.gov. The board is located at 1075 Mullins Station Road, Suite C-142, near the Shelby County Corrections Center.

The increased values this year are a far different situation from the last reappraisal year in 2013. At that time, the effects of what has been called the “Great Recession” caused a major drop in home values across the county and nation. Governments had to increase their tax rates to maintain the same revenue as in 2012. For example, the county’s tax rate went from $4.02 in 2012 to $4.38 in 2013. However, an official in county Assessor Cheyenne Johnson’s office said at the time that even with the higher rate, about two-thirds of homeowners would receive a reduction in their county taxes.

For most homeowners, those reductions have continued until this year’s reappraisal.

No Windfalls…Supposedly

Reappraisals affect property owners individually in an effort to have each person pay his or her fair share of taxes. Generally under a reappraisal, some people pay higher taxes, some pay the same and some pay lower taxes.

County commissioners in May approved a certified county property tax rate of $4.137, a reduction from the past year’s $4.37 for each $100 of assessed value.

Memphis City Council members approved a $3.271 city certified rate, a cut from the current $3.40.

If these figures turn out to be the actual rates that the governments set, the county break-even point on taxes would be a 5.6 percent reappraisal increase. The city’s break-even point would be a 3.94 percent reappraisal increase.

Property owners whose reappraisals increased more than these percentages would have tax increases and those whose reappraisals went down or were less than these percentages would have tax cuts.

Calculations through the years have indicated that in several reappraisal years through the decades Memphis and Shelby County governments have received revenue increases as a result of reappraisals by having appeals allowances in their certified tax rates that produce more revenue than the governments lose in revenue from successful appeals.

State law provides a procedure to address this but it never seems to work as far as Memphis and Shelby County governments are concerned.

Assessed Values for Tax Purposes

Places 2016 2017 Increase % Increase

Shelby Co. all $16,871,863,015 $18,963,394,275 $2,091,531,260 12.4

Arlington $294,855,710 $338,870,090 $44,014,380 14.9

Bartlett $1,146,813,937 $1,303,003,810 $156,189,873 13.6

Collierville $1,505,569,330 $1,725,044.030 $219,474,700 14.6

Germantown $1,447,257,150 $1,637,981,540 $190,724,390 13.2

Lakeland $315,999,720 $350,643,485 $34,643,765 11.0

Memphis $10,300,420,103 $11,521,720,355 $1,221,300,252 11.9

Millington $164,444,435 $188,394,465 $23,950,030 14.6

Unincorporated $1,696,502,630 $1,897,736,500 $201,233,870 11.9

***

This post is written by Jimmie Covington, veteran Memphis reporter with lengthy experience and expertise covering governmental, school, and demographic issues. He is a contributing writer with The Best Times, a monthly news magazine for active people 50 and older, where this appears in its latest issue.

Memphians have always suffered some of the highest property taxes in Tennessee. We get only poor public services but plenty of high crime, terrible schools, blighted properties, bad roads and nothing much else.

Thanks for not depriving of us of your normal wisdom and balanced comments.

More Taxation with even fewer services.

“Brilliant at the basics”.

Sincerely,

Jim Strickland

Mayor of Memphis

Although Memphis and Shelby governments may wind up with limited tax increases as a result of receiving approval for higher appeals allowances than needed to offset the impact of reappraisal appeals, the reappraisal values have nothing to do with budgets and how either government spends its money. The purpose of a reappraisal is to provide more equity in the property taxes that each taxpayer pays compared to other taxpayers. As the piece says, during every reappraisal some property owners wind up paying higher taxes, some wind up paying the same and some wind up paying lower taxes. Vigilance on the part of the public and the news media is the way to deal with appeals allowances that are too high. jcov40

Jimmie: Do local governments “hide” a small amount of money in the appeals allowances? Is there not a reconciliation in the future to determine if the local governments got more money than they should have?

There is a procedure calling for governments to re-certify the tax rate in the first year after a reappraisal year to show the impact of appeals and roll back the tax rate if the allowance were too high. However, because of of the high number of appeals in Shelby County it usually takes two or three years or longer for all of the appeals to be resolved. Memphis and Shelby County governments go through the process of identifying a re-certified rate based on the amount of appeals handled in the first year and then move ahead and re-adopt the rate they had adopted in the reappraisal year. Remember the law is a truth in taxation law and is not a law that requires an actual rollback in the tax rate. Officials just have to alert people what rate would be needed to bring in the same total revenue as the previous year. Then they can advertise a public hearing and afterward set whatever rate they wish to set. jcov4o

Thanks for the explanation. So the answer is yes, governments can hide a tax increase within the appeal allowance.