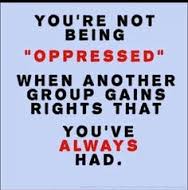

The soon-to-be-ending (mercifully) presidential campaign has been marked with more bizarre events and comments than any in memory, but the strangest thing about it from our perspective is the way a significant percentage of white men consider themselves victims of discrimination and a system stacked against them.

And they manage to do it while denying that institutional racism and white male entitlement even exist.

Many think it’s “the other” who is responsible for the difficulties in their lives: African Americans, Latinos, Muslims, and feminists…although many of the problems in their lives are the result of voting against their own interest for decades.

Even now, faced with growing inequity and decline of the middle class, they are seduced into believing that “trickle down” economic plans benefit them and that more tax breaks for the megarich are actually prerequisites to jobs creation. They embrace a tribalism that gives cover to white nationalists and xenophobes to the point that even religious principles can be overlooked for the appealing jingoism of intolerance.

True Believers

Life in the bubble of talk radio, Fox News, and an Internet full of the bewildering conspiracies feed many white men’s victimhood and convince them that only people who agree with them are true Americans, true Christians, or true patriots. People with different opinions are simply crooked, corrupt, and undeserving of respect. It’s all made even more confusing since the America they rail against is largely one created by white men.

It’s an attitude that leads to lives of self-fulfilling prophecies. They only hear what validates their previously held opinions and they discard the rest, even if they are scientific facts, which they often answer with a sentence that begins, “I don’t believe…” as if science fact is a belief system rather than measurable evidence that result from specific principles of reasoning and research.

We’re not saying that many of these men – whose resentment stems from the crushing of the middle class dream – have reason for complaint but it is bewildering how many of them turn this resentment toward minorities rather than at the right wing politicians who enact the policies that has over the past 30 years or so that has concentrated wealth of the top 1/10 of 1% equals the wealth of the bottom 90%.

As for African Americans, specific federal policies on housing and the redlining that enforced them blocked the greatest sources of middle class wealth – a house and an education – while the era of Jim Crow denied the right of self-determination.

Economic Justice Helps Everyone

Today, many of these white men not only don’t show empathy toward African Americans but react negatively to any policies and plans aimed at redressing the government’s direct role in limiting African American opportunity. The most incredible news media moments have been panel discussions on which white men tell African Americans they are wrong to label something as racist or tells a Latino that they should not be offended by crass rhetoric. That so many people, by a coincidence of birth, were born white but chalk up the entitlement that comes with it to their own ingenuity is a standard of America.

As a result, they default to “all lives matter” rather than understand the meaning and the implications of Black Lives Matter while the irony of this kneejerk pushback to any suggestion that black Americans have grievances and grounds to march and picket is that the same economic justice agenda they advocate would benefit a large segment of the white males who so viscerally react as victims.

Source Materials

For example, The Movement for Black Lives lays out well some of the sources of overriding economic injustice:

* There is a desperate need to replace the current practice of collecting revenue in regressive ways with a more just system for collecting taxes.

* Across the United States, there are major political obstacles to raising any kind of revenue, along with a false perception of who pays and how this has changed over time.

* As with most injustices in our economic and political systems, regressive taxation has hit Black people, low-income people, and people of color the hardest.

* Many municipalities have increasingly decreased the use of progressive taxation and instead resorted to privatization and new fees and higher sales taxes in order to maintain bare-boned public infrastructure with minimal social support. As a result, residents are being forced to pay more for public services like trash collection, access to water, sewage, public property maintenance, and parking meters.

Sources of the Problem

* Across the country, low-income people, disproportionately Black and other people of color, pay proportionally more in state and local taxes than the wealthy: In the ten states with the most regressive tax structures, the poorest fifth pay up to seven times as much in state and local taxes and fees as the wealthiest residents, as a percentage of their income.

* The wealth gap between white and Black households keeps growing, with the average white family now owning over 7.5 times as much wealth as the average Black family. Tax breaks for homeowners, retirement savings, employer-sponsored health insurance, and capital gains contribute to widening this gap.

* When states are not shifting the cost of public services onto poorer residents, they cut services all together, which affects poorer communities the most. Many municipalities, oftentimes with majority Black populations, have increased public school class sizes, shortened school days, closed vital city offices, reduced public transportation, reduced affordable housing assistance, cut essential health care programs, and eliminated public sector jobs.

* As the wealthiest Americans and powerful corporations continue to evade their fair share of taxes, many public services, programs and initiatives that could increase racial and economic justice go underfunded or unfunded.

Goals That Matter

The economic justice agenda’s important goals:

* Progressive taxes on income to raise revenue more equitably:

* Raise marginal tax rates for high earners, specifically the top percentile (the top 1% have seen their effective tax rate reduced to around 20 percent, down from 90 percent in the 1960s). Begin by raising the top marginal rate first to 50 percent and then gradually up to 80 percent.

* Remove income caps on payroll taxes that fund social security and unemployment insurance.

* Raise corporate income taxes, especially on large corporations and end tax deferral for foreign income of multinational corporations.

* Taxes on wealth to reduce the wealth inequality: Increase taxes on capital to the point where they are higher than taxes on labor, as wealth inequality is greater than income inequality.

* Remove harmful tax breaks and tax undesirable activities instead: Taxing “bads” not “goods”: shift from sales taxes to taxing externalities such as environmental damage, and make this approach income-sensitized to hold low-income people harmless; Make low-wage employer pay penalty fees or levy a payroll tax rate proportional to wage disparity; Expand the earned income tax credit; Provide a universal child tax credit, and Create mechanisms for sharing tax revenues.

More Agenda

* Ensure that property taxes and other local taxes are income sensitized.

* Eliminate corporate tax breaks at the city level, particularly Tax Increment Financing and Business Improvement Districts.

* Implement progressive municipal income taxes.

* Apply conservation pricing on utilities so lower-income households pay a lower rate and bulk or excessive users — such as commercial and industry — pay higher rates.

* Charge different rates of property tax for residential, second home, and commercial and industrial properties with higher rates for higher value land, such as a “mansion tax.” Impose an anti-speculation tax on property transfers.

* Ally with community organizations to exert political pressure on large tax-exempt institutions to forge Payment in Lieu of Taxes (PILOT) agreements.

There is more detail, and all is worth reading, at The Movement for Black Lives.

Facing It

Sadly, this presidential campaign has hardened opinions, and more than ever, many white men seem even more committed to their self-image as victims. Their victimhood even overshadows their enlightened self-interest, which otherwise could open their minds to understand their shared interest in the economic agenda of Black Lives Matter organizations.

This would of course require white America to quit being dismissive of black rage and frustration and come to grips with their causes. White America needs to quit dismissive bromides like “All Lives Matter” in the face of African Americans willing to have a serious discussion about race. White America needs to abandon the victimhood of reverse racism as a way to deny anti-black bias. And white Americans need to stop the double standard that supports protests until the protesters are people of color.

Until then, claims of American exceptionalism ring hollow. After all, before we can claim our duty to transform the world, we have to transform it here at home. There is no “city upon a hill” until its doors are open to every person and it is a place where they can find equal opportunity, liberty, and justice.

There is the point at which race and poverty can no longer be explained away by any of us as a coincidence, and we have reached it. While we have all the data we need to frame up today’s problems and challenges for tomorrow, it’s the human face of it all that should shame us into action and that face is not of a white man.

***

Join us at the Smart City Memphis Facebook page for daily articles, reports, and commentaries that are relevant to Memphis.

Intriguing recommendation for an 80% marginal tax rate; perhaps we can also replicate the economic stagnation of the 1970s. You’ve also mischaracterized many of Trump’s positions as xenophobic and jingoistic but no one seems interested in reality these days.

Trump’s “policies” are essentially warmed over and disproven economic policies of the past. It’s all about the effective tax rate as opposed to the marginal tax rate. It’s like all the corporations crying about 35% tax rate when they average paying 15%. We’ve not seen a xenophobic, racist candidate like Trump since the days when we were a reporter covering George Wallace. And the main point is to ask why white men feel so put upon in a society where they wrote the rules?

There isn’t any mischaracterization of trump’s “policies,” which are all about placating an aggrieved bunch of losers. Coal miner out of work in WV? Then get off your ass an move to where there are jobs, maybe in Texas. That’s what a ruggedly independent, big government hating free market Ludwig Von Mises conservative would do, right?

Trump supporters are a big bunch of entitled whining crybabies.