We write regularly about how the tax holiday program for corporations in Memphis and Shelby County is broken and how, despite our largesse in doling out approximately $80 million in tax waivers a year, our economic trend lines are still going decidedly in the wrong direction.

We add that we are not one of those who believes the PILOT program should be shut down and that all incentives are bad. There are times when they are crucial and justified, especially when they are aimed at creating public benefits that extend beyond the job creation itself and are targeted and strategic. But we do believe that tax freezes long ago quit acting as incentives and became entitlements. There are some simple changes that can be made to restore public confidence, such as reducing the maximum number of years for a PILOT (Payment-in-lieu-of taxes), reducing the amount of taxes waived below 75%, carving out all property taxes that would otherwise go to education, and ending the policy that allows international companies to say the magic words, “we’re thinking about moving to Mississippi” and get a new 15-year PILOT after the original one has expired (suggesting that if you’re big enough, you may never have to pay property taxes again).

Then again, Shelby County Board of Commissioners and Memphis City Council – which have delegated their power to grant tax freezes to EDGE and Downtown Memphis Commission – could create a ceiling for the amount that can be waived per job, because now, some of the per job costs of the tax benefits make little sense, or a ceiling for the total amount of taxes can we waived in a year.

Too often, in these deals, PILOTs become lagniappe, an extra goody companies demand because they know they can. The drain on revenues is what led the Tennessee Comptroller to express his concerns about the aggressive use of PILOTs and how they “cut into future property tax revenue growth” in his 2013 strongly worded letter to city finance officials stating his concerns about their government’s fiscal health. But his concerns are drowned out by the intense lobbying that begins whenever changes are even suggested to the program, and why often in government circles, the justifications for our overreliance on tax freezes comes from the beneficiaries of them.

Magic Answers

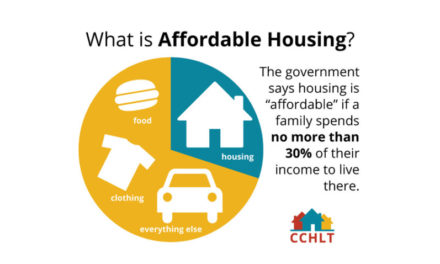

There is general consensus among most economists and policy analysts that incentives are not good economic development policy, because 1) tax burdens are shifted to homeowners and small businesses (and small businesses are where most of the new jobs come from), 2) government is subsidizing big companies with scarce tax dollars that amount to a small fraction of their yearly incomes, 3) it’s tantamount to government picking winners and losers, which it has no expertise in doing, and 4) it deludes people from focusing on other smarter business job creation strategies and ways to create a better business climate.

Equally important, these tax giveaways give the appearance of being an easy solution, a magic answer, to economic problems that are always complex and frequently frustrating. It puts skeptical elected officials in a bad position – as the deal killer – and there is always more reward in taking credit for making a deal happen than in rejecting it and being second guessed. That’s especially true when you are term limited and the 15-year PILOT will continue long after you’ve left the public stage.

Also, there’s just something to be said for all the photo ops at those ribbon-cutting events. They’re the stuff of winning campaign brochures.

Research has shown – and so has every day experience here with PILOTs – that incentives are often explained by the “my neighbor is doing it” argument rather than by careful analysis or contrary explanations.

In other words, the goal for Memphis and Shelby County should be to find ways to make our community attractive without giving away the tax base, without selling Memphis and Shelby County on cheapness rather than quality, without shifting more of the tax burden from companies to homeowners, and without using incentives selectively and strategically.

Start at the Beginning

So, what exactly should we do?

It’s been said that indiscriminate incentive-mad policies only lead to disaster with growing fiscal problems in local government, indiscriminate deal-making, and political backlash. We’ve seen all three already in Memphis and Shelby County.

And yet, there is a different course of action, and in its way, it is a return to common sense and logic.

First, Memphis and Shelby County must compete on quality public services. There’s nothing that says more about a city than its public services and its quality of life investments – parks, effective policing, good K-12 schools and colleges, and customer-friendly services. As someone said to us today about cities generally, if a city can’t pick up a dead dog on the street, what makes us think it can provide the services we need as a business?

A New Way of Acting

Second, Memphis and Shelby County must shake their focus on tax competitiveness alone. Our community needs a well-balanced tax policy that supports a fiscal system that is predictable, efficient, and accountable. the

Third, Memphis and Shelby County should limit PILOTs to strategic targets. The justification for a tax waiver has to be more than “they’re doing so we have to do it too,” and we need to set priorities in the kinds of companies we want and reward them for achieving our public policy objectives like inner city job development, and finally, quit giving away taxes to distribution centers who should understand the value of being in a city with its world-class logistics. Or restrict PILOTs to slow-growing areas, give them to companies that invest in research and development, find a way to support entrepreneurs, and make the incentives so they are fair to all companies and not just the one we’re chasing.

Fourth, Memphis and Shelby County should develop a return on investment analysis that is more complete, including at least the offsetting costs shifted to homeowners of providing the services needed by the companies. EDGE has been recognized by anti-incentive organizations for its transparency, and it should continue in that direction by getting ahead of the coming requirement by the Governmental Accounting Standards Board (GASB), which sets the accounting standards for state and local governments, that every government will disclose in a standardized way the costs of its corporate incentives.

Fifth, we need our leaders to find another way. The Comptroller’s letter was a shot across the bow with the state comptroller’s letter that included his concern about the amount of taxes being waived here. Our economic development officials say that we need to hand out so many PILOTs because our workforce is poor, our toolkit is light, and our educational attainment is low. If that’s the case, let’s work on the underlying issues that would reduce our dependency on PILOTs and abandon the arms race with North Mississippi which has thrown out any reasonable rules of economic theory.

Well, Which Is It?

The overriding problem here with PILOTs and it’s why they receive heavy criticism from the public is that they are ubiquitous and seem automatic to any company that knows how to fill out the paperwork. That said, they contradict all the glowing rhetoric about how much Memphis and Shelby County are progressing, begging the question: if we are doing so good and our community is so great, why are we having to pay companies to love us?

It’s ironic that at a time when many CEOs challenge all things governmental, they find nothing untoward about what critics are calling “wealthfare.” On one hand, we’re all told that capitalism and market forces are paramount, but in essence, isn’t the proliferation of PILOTs making the exact opposite case? It seems to say that capitalism is failing and companies can’t compete in the marketplace.

As we said in our first post, we’re not for unilateral disarmament, but we’re way past being influenced by the fear brigade that acts like that any requirements on companies and strings on incentives will lead to a slower growing economy. These are the “PILOTs may not be good but they are necessary” apologists, but in taking that position, they abdicate the importance of wise public investments, customer-friendly and accountable public services, and a clean, green, safe, and tolerant community in driving economic growth.

Fresh thinking is needed here about tax waivers, not just because the public is demanding it but because for a decade, they have not been a boon that led to a much expanded economy for Memphis and Shelby County. We need to move past simple ideas about tax competitiveness and simplistic anti-government rhetoric to concentrate on the real disincentives to economic competitiveness and growth.

That’s the road to developing real incentives that attract new jobs and business investment.

This post updated from one on February 14, 2014