From Washington Post:

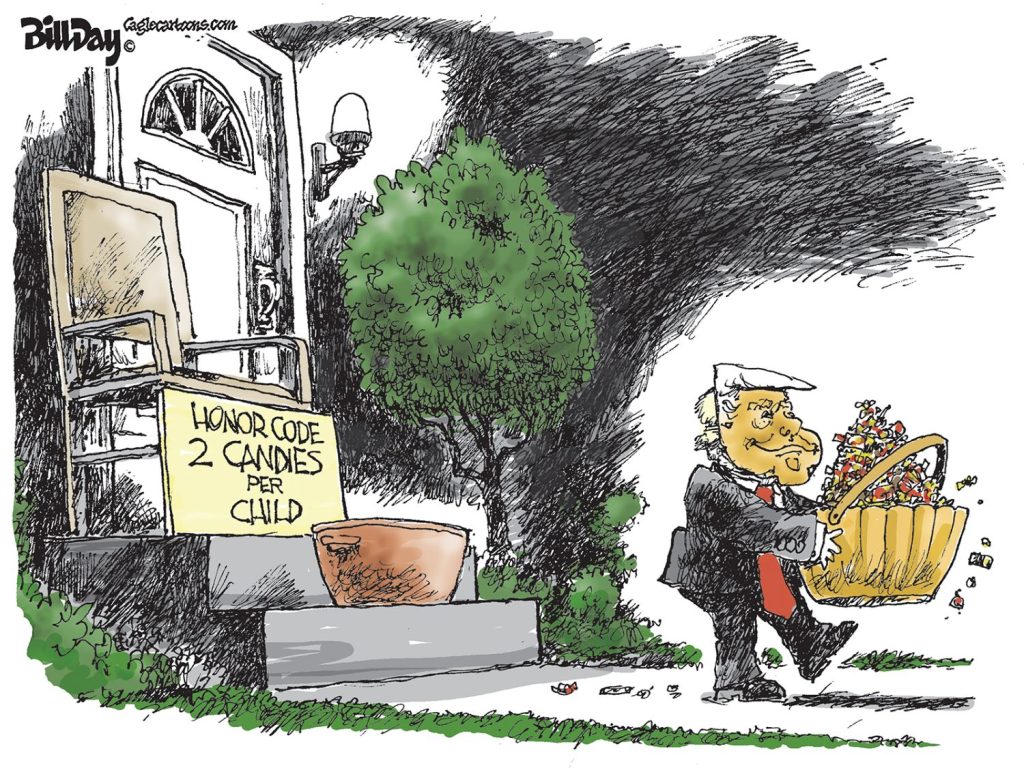

If you can’t build your own, steal someone else’s.

That, one economist notes, has become the default strategy for state and city governments in their pursuit of rapidly growing businesses, with many offering increasingly lucrative incentive packages to encourage employers to move to and create jobs in their districts.

However, that’s hardly the most sustainable method to promote the country’s economic growth — and there’s new evidence that it’s not particularly effective at a local level, either.

“It’s a zero-sum game,” Nathan Jensen, a political science professor formerly at Washington University in St. Louis who recently started teaching at George Washington University, said during a recent conference held by the Kauffman Foundation.

Simply shifting companies from one state to the next does nothing, at least not right away, to create new openings for the millions of still unemployed Americans, Jensen added while presenting some of his latest economic development research. Nevertheless, nearly every municipality across the country offers some type of tax incentives to encourage existing companies to relocate, costing taxpayers around $70 billion annually.

Often, the hope is that those incentives will not only prompt employers to bring their existing jobs to this state or that city, but that it will also accelerate the company’s future growth and generate additional jobs for residents down the road.

But does that actually work?

“It’s a difficult question to answer,” Jensen said, noting that “economic development officials often lift up past performance of incentive packages by measuring the growth and job creation” of firms that received tax breaks in exchange for their relocation.

“However, if the company was promising enough to be courted for relocation, it should come as little surprise that company grew,” he added. In all likelihood, he added, the company would have expanded had it stayed put in its previous home.

As part of his research, Jensen took that standard evaluation one step further by comparing job creation of companies in Kansas that were poached using tax breaks to that of similar firms (in terms of size and industry) that were considered for but ultimately not awarded that type of incentive.

What he found was that, in the six years after incentives were awarded, “the firms who received incentives actually generated slightly fewer jobs than those that didn’t receive incentives. Moreover, after the initial bump resulting from their relocation, Jensen found that transplanted companies were no more likely to generate jobs than similar companies that were already operating in their state.

He thus concluded that there is “no evidence” that those oft-used tax incentive programs have any positive effect on job creation. In fact, by cutting into public funds that could have been used for other programs that, say, spur private investment or fund research, and by making it harder for employers who do not receive tax breaks to compete in the market, the programs may actually be having a detrimental effect.

“Maybe this is a downer,” Jensen told the room full of economic development officials. “But I’m sorry, this is what the data says.”

Despite the research, because incentive-based programs are now deeply ingrained in the economic development system nationwide, Jensen acknowledged that there’s little chance state and city officials will abandon the practice for fear of losing firms to their neighbors.

“There are a lot of inefficient policies that exist. “Jensen said. “This is a classic case.” But that doesn’t mean the programs cannot be improved.

Of the vast majority of municipalities that offer tax incentives to attract companies, only about a third have a formal review process in place to assess whether the programs are actually bolstering job growth and economic output, Jensen said. In addition, most of the programs do not have any clawback provisions or consequences for firms that relocate but later sputter, go out of business or relocate again.

Both are areas where economic development officials could better ensure they are getting the most value for every taxpayer dollar spent.

Peter Fisher, a professor of urban and regional planning at the University of Iowa who spoke at the conference, pointed out that most of the nation’s net new jobs every year are generated by new and small companies, leading an increasing number of economists to place emphasis on entrepreneurial activity and new business formation.

However, Fisher, who has spent more than a decade evaluating various types of tax incentives, noted that very few around the country target small businesses. In fact, many “have size thresholds that mean they are unavailable to small firms,” he said.

“So there’s a very strong bias in these incentive programs toward established corporations that may bring a big number of jobs that makes for a good headline and helps advertise the success of the program,” Fisher said. Consequently, he added, governors and mayors are missing an opportunity to instead “stimulate innovation that would lead to probably far more jobs down the road.”