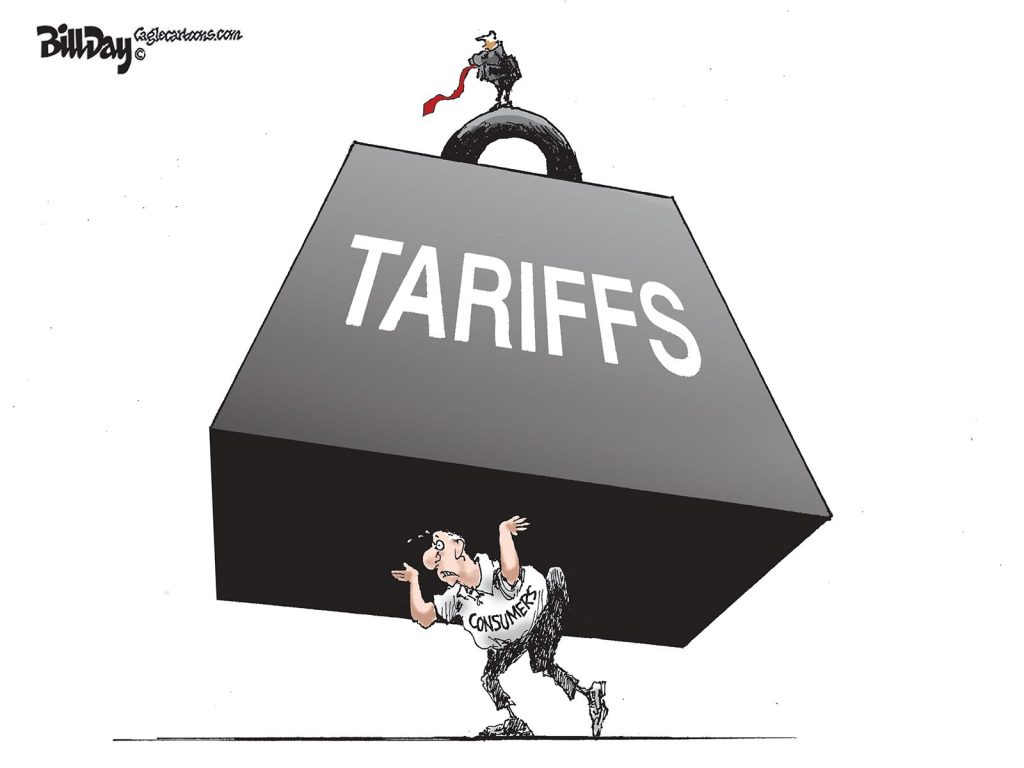

It’s a buyer’s market for companies looking to locate in Memphis. About $50 million in tax waivers given out by Memphis and Shelby County remain in effect. More tax freezes have been approved here than in seven other major Tennessee counties combined, and it’s hard to find a city with a similar over-reliance on them.

Economic development officials have said for 25 years that these financial inducements are necessary to bring new jobs to Memphis because of problems with our workforce, but little has been done to improve the workforce over the same period of time. More to the point, local government has a history of approving property-tax freezes for companies with the low-skill, low-wage jobs that are more and more headed for third-world countries.

All that said, it’s still hard to argue with the decision to open the city, county, and state government cash registers for Electrolux and Mitsubishi.

It’s All About Context

There has been some political blowback as a result of the $179 million for 1,240 direct jobs at Electrolux paying an average of $31,000 and $34 million for 281 jobs at Mitsubishi paying an average salary of $50,000, because the average incentive per job is about $140,000 — a number normally associated more with incentives for auto manufacturing jobs. (In essence, government is building the plant for Electrolux.)

And yet, incentives for new jobs have to be considered within current economic realities, and times have been hard for Memphis. As the Greater Memphis Chamber of Commerce pursued these companies, it was not lost on them that our economy had lost almost 35,000 jobs in the past nine years and in a ranking of the 100 largest regions, our region was ranked 89th in private sector jobs growth.

Job loss often begets more job loss because a city is seen by companies as in decline and it becomes a self-fulfilling prophecy. That’s why Chamber officials were desperate to change our narrative. But the really good news is that, supported by former Tennessee Governor Phil Bredesen, Memphis Mayor A C Wharton, and Shelby County Mayor Mark Luttrell, they were able to do more than just add 1,521 direct jobs and about twice that many indirect jobs.

Reasons

First, these jobs are in the urban core where existing infrastructure can be used without expensive new investments by taxpayers. Second, these are 1,521 manufacturing jobs, which continue to be the gold standard for cities like ours without a deep knowledge economy and with the need for jobs that pay more than just a living wage.

Third, these two plants — Electrolux will build ranges, wall ovens, and cooktops in 700,000 square feet, and Mitsubishi will build 400-ton, boxcar-sized electrical transformers in 330,000 square feet — could expand Memphis’ export economy beyond our traditional trading partners of Canada, Mexico, United Kingdom, Japan, and Germany into the emerging markets in South America, India, and China.

Memphis and Shelby County governments agreed to split $44 million in local incentives, and once again, our Noah’s Ark approach to funding projects means that Memphians pay a disproportionate share, paying 100 percent of the city’s $22 million and then paying about 70 percent of the county’s $22 million.

Tourniquet

Simply put, Memphis and Shelby County needed to do something dramatic to stop the bleeding of jobs and combat the negative trend lines for our economy. There’s no question that these kinds of large subsidies and incentives are unsustainable as long-range economic development policy, but on these two projects, the Greater Memphis Chamber of Commerce had little option but to adopt the approach that if you find yourself in a hole, the best thing to do is stop digging.

That said, if Memphis and Shelby County are to continue their over-reliance on tax freezes, it’s time to consider Community Benefits Agreements for companies that receive public incentives. These agreements — contracts between a company and a community coalition — set out the benefits that the city will get in return for its incentives. The most common benefits are living wages, local hiring, job training, environmental remediation, and funding for community programs.

For example, in an agreement in Washington, D.C., a company agreed to hold a job fair, to sponsor field trips for students, create hiring preferences for neighborhood residents, support for an arts festival, and internships. In cities like Atlanta, Los Angeles, Minneapolis, Milwaukee, and Seattle, these agreements have come from a grassroots movement demanding a reciprocal arrangement with new businesses. Memphis could be a pioneer by making these community benefits agreements part of the public approval process for tax freezes and subsidies.

Previously published in the May issue of Memphis magazine.

I don’t know if you have the statistic on how this would be reported, but what does it look like in the numbers if people relocate to Memphis bringing their income without taking any Memphis jobs?

For example what if people who work remotely move to Memphis. The jobs were not taken from Memphis residents, and the “income” is entirely new to the Memphis economy. How is that reflected on their jobs gain/loss reports?

I like the idea of the Community Benefits Agreement being a new component wielded by the EDGE group. One issue is we need agreements with teeth, but the perception of our situation prevents local officials from implementing anything that might appear aggressive to prospective employers. This also speaks directly to a multi-priority focus the Chamber and the EDGE should maintain.

I would still like to see a redesign of our local tax incentives and policies in order to provide active financial assistance to start-ups and local entrepreneurs.